Kiva

What is Kiva?

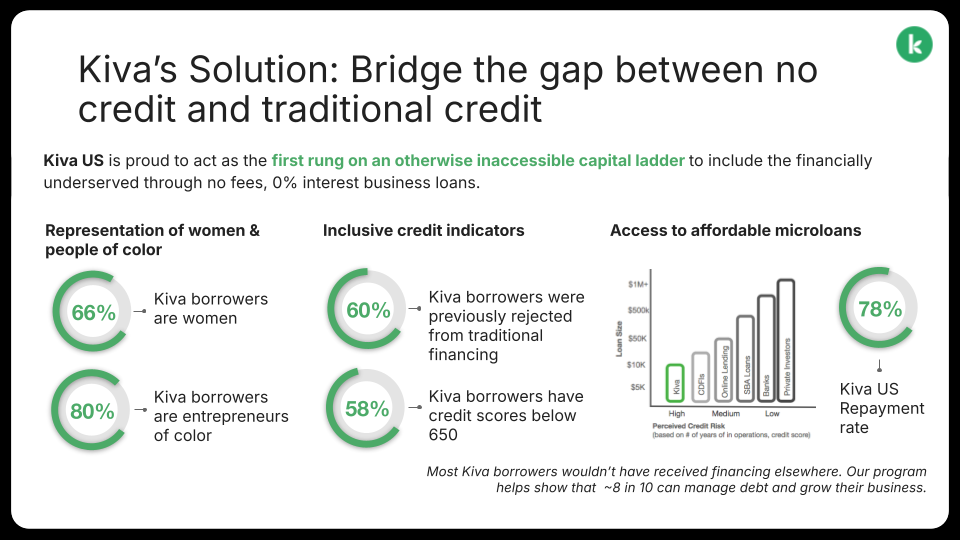

Kiva expands financial access to help underserved communities thrive by using crowdfunded microloans, creating a space where individuals can have one-to-one impact while collectively opening doors for entrepreneurs who are often overlooked by traditional lenders. Kiva has funded over $2 billion in loans through the power of relending, proving that small contributions can add up to transformational change for founders around the world.

Global Impact

〰️

Local Change

〰️

Global Impact 〰️ Local Change 〰️

Global Impact,

Local Change

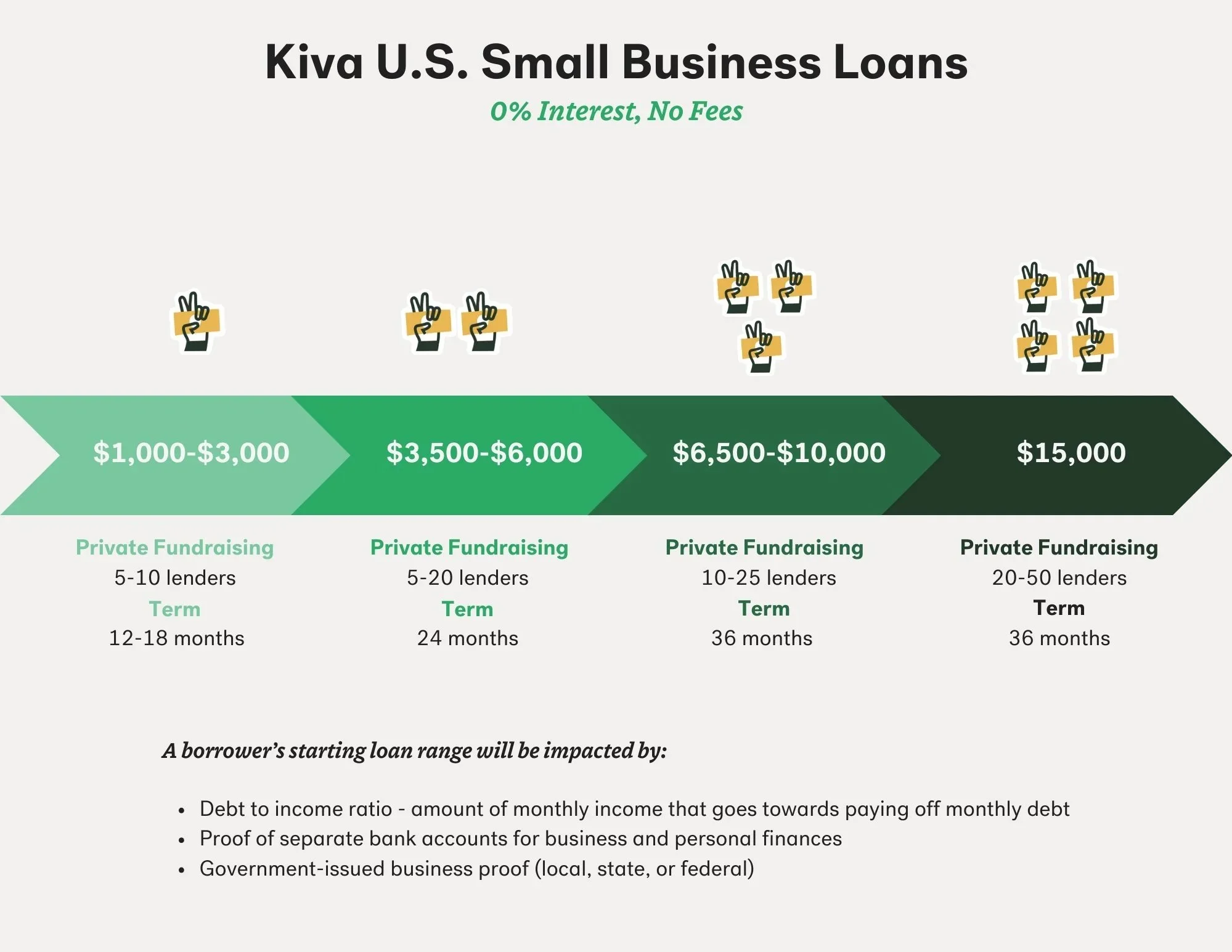

Through ISM, U.S. small business owners can access 0% interest Kiva loans with no fees, no collateral, and no minimum credit score. This platform provides crowdfunding opportunities for entrepreneurs where conventional lenders will not, supporting ventures at all stages and from all backgrounds. By connecting local founders to Kiva’s global community of lenders, ISM helps entrepreneurs organize their information, understand what is needed for a successful application, and take the next step toward sustainable growth.

How it Works

1. Apply

If you’re eligible, simply apply!

2. Invite

Invite friends and family to lend you $25

3. Fundraise

Go public on Kiva, visible to over 1.6 million lenders

4. Repay

In up to 36 months

Apply for a Kiva Loan

Organize Your Documents Ahead of Time

Kiva’s US Impact

8 of 10

PEOPLE INCREASED INCOME

$80 M

lent

12K

LOANS FUNDED

24K

PEOPLE REACHED

What loan size do I qualify for?

Personal and business finances

Character references

Online presence

Quality of your loan description

Kiva U.S. looks at a multitude of factors:

Kiva does a soft pull of a borrower’s credit score; however there are no minimum credit score requirements.

Reach out to ISM and set up an appointment to discuss the Kiva process:

USA / English

USA / English عربى

عربى Pусский / Россия

Pусский / Россия